Filing the annual report with the Arizona Corporation Commission (ACC) is a crucial responsibility for businesses operating in Arizona. This document ensures that your company remains compliant with state regulations and maintains its good standing. Neglecting this requirement can lead to penalties, fines, or even dissolution of your business. Therefore, understanding the process and adhering to deadlines is essential for every business owner or manager.

Arizona Corporation Commission plays a vital role in overseeing businesses incorporated within the state. The annual report serves as a formal communication between your business and the ACC, providing updates on key aspects such as business operations, registered agents, and financial details. This ensures transparency and accountability in the business ecosystem.

In this article, we will delve into the step-by-step process of filing your annual report, highlight common pitfalls, and provide tips to make the process smooth and efficient. Whether you're a seasoned business owner or a newcomer, this guide will ensure you stay compliant and avoid unnecessary complications.

Read also:Sajdecom Your Ultimate Guide To Discovering The Best Deals And Services Online

Table of Contents

- Introduction

- What is an Annual Report?

- Who Needs to File?

- Filing Process

- Important Deadlines

- Common Mistakes to Avoid

- Fees Associated with Filing

- Benefits of Filing the Annual Report

- Penalties for Non-Compliance

- Tips for Successful Filing

- Conclusion

What is an Annual Report?

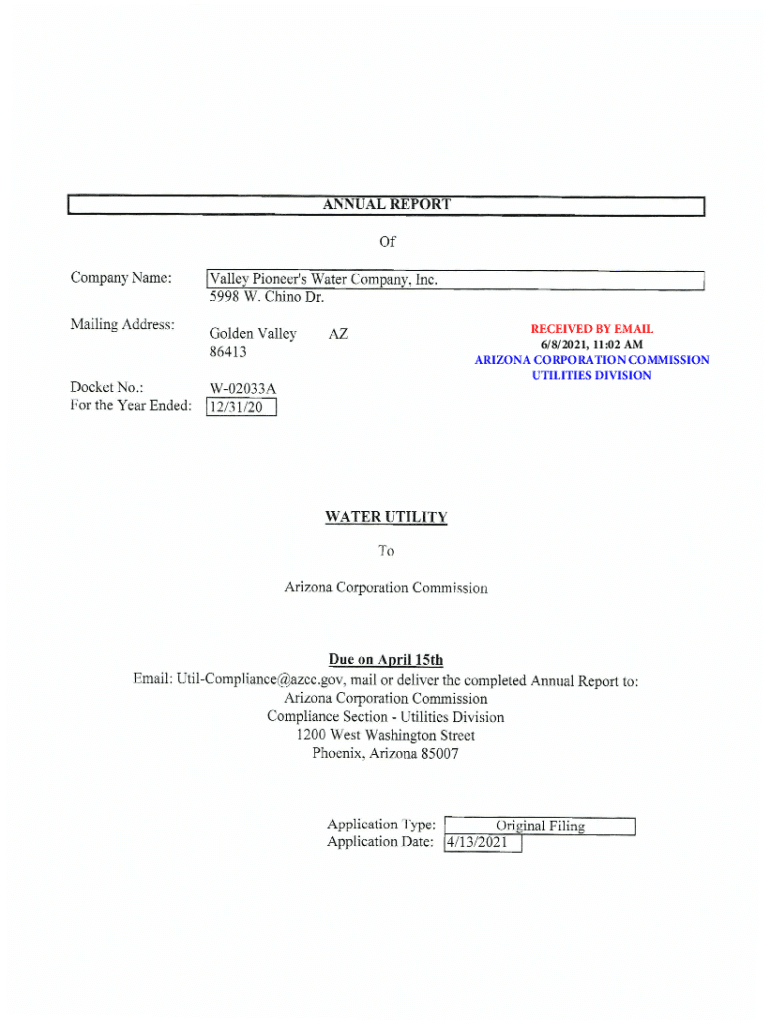

An annual report is a formal document submitted by businesses to the Arizona Corporation Commission. It provides updated information about the company's activities, governance structure, and financial status. This report ensures that the business remains compliant with state laws and regulations.

For Arizona businesses, the annual report is not just a formality; it's a legal requirement that helps maintain the entity's active status. The report includes details such as the company's name, principal office address, registered agent, and other relevant information.

Why is it Important?

- Ensures compliance with state laws.

- Keeps your business in good standing.

- Protects your business from penalties and fines.

- Provides transparency and accountability.

Who Needs to File?

Not all businesses are required to file an annual report with the Arizona Corporation Commission. Typically, the following entities must comply:

- Corporations (C-Corporations and S-Corporations).

- Limited Liability Companies (LLCs).

- Limited Partnerships (LPs).

- Professional Corporations (PCs).

It's important to note that sole proprietorships and general partnerships are generally exempt from this requirement. However, if you're unsure about your business's classification, it's best to consult with a legal expert or the ACC directly.

Filing Process

Filing your annual report with the Arizona Corporation Commission can be done either online or by mail. Here's a step-by-step guide to help you through the process:

Step 1: Gather Required Information

Before you begin, ensure you have the following details ready:

Read also:Enhypen Age Now Exploring The Young Stars Taking The Kpop World By Storm

- Business name and entity type.

- Principal office address.

- Registered agent name and address.

- Names and addresses of directors or members.

Step 2: Choose Your Filing Method

Most businesses prefer the online filing method due to its convenience and speed. However, if you choose to file by mail, ensure you use the correct form and send it to the appropriate address.

Important Deadlines

One of the most critical aspects of filing your annual report is adhering to deadlines. The Arizona Corporation Commission requires that all annual reports be submitted by May 1st of each year. Failure to meet this deadline can result in penalties and additional fees.

It's advisable to file early to avoid last-minute complications. Setting reminders or using automated systems can help ensure timely submission.

Common Mistakes to Avoid

Even experienced business owners can make mistakes when filing their annual reports. Here are some common errors to watch out for:

- Submitting incomplete forms.

- Missing deadlines.

- Providing outdated or incorrect information.

- Not paying the correct fees.

Double-checking your submission before finalizing can save you from unnecessary headaches and penalties.

Fees Associated with Filing

Filing fees vary depending on the type of business entity. As of the latest update, the fees are as follows:

- Corporations: $50.

- LLCs: $50.

- Limited Partnerships: $50.

These fees are subject to change, so it's always a good idea to verify with the Arizona Corporation Commission's official website or contact them directly for the most accurate information.

Benefits of Filing the Annual Report

While filing an annual report might seem like a tedious task, it offers several benefits:

- Maintains your business's active status.

- Enhances credibility and trustworthiness.

- Provides a clear record of business activities.

- Helps in securing loans or attracting investors.

By staying compliant, you ensure that your business can operate smoothly and take advantage of various opportunities.

Penalties for Non-Compliance

Failure to file your annual report on time can result in severe consequences:

- Financial penalties and late fees.

- Suspension of business operations.

- Possible dissolution of the business.

These penalties can have long-term impacts on your business, affecting its reputation and financial health. Therefore, it's crucial to prioritize this responsibility.

Tips for Successful Filing

To make the filing process smoother and more efficient, consider the following tips:

- Start early to avoid rush and errors.

- Double-check all information before submission.

- Use online filing options for faster processing.

- Keep a record of your submission and confirmation.

By following these tips, you can ensure a hassle-free experience and maintain compliance with state regulations.

Conclusion

Filing your annual report with the Arizona Corporation Commission is a vital aspect of running a business in Arizona. It ensures compliance, maintains your business's good standing, and protects you from penalties. By understanding the process, adhering to deadlines, and avoiding common mistakes, you can navigate this requirement effectively.

We encourage you to take action now by gathering all necessary information and preparing for the filing process. If you have any questions or need further clarification, feel free to leave a comment below. Additionally, consider exploring other resources on our website to enhance your business knowledge and success.