Understanding Colorado 1099-G tax refund is crucial for anyone who has received government payments or unemployment compensation during the tax year. This document provides detailed insights into the process, benefits, and steps to claim your refund effectively. Whether you're a resident of Colorado or planning to file your taxes in the state, this guide will help you navigate through the complexities of 1099-G forms and refunds.

The world of taxation can often feel overwhelming, especially when navigating forms like the 1099-G. This form is issued by government agencies to report certain payments made to individuals, which may include unemployment compensation, state or local income tax refunds, or other government payments. For residents of Colorado, understanding how this form impacts your tax return is vital.

As we delve deeper into the intricacies of Colorado 1099-G tax refund, you'll uncover essential tips and strategies to ensure you're maximizing your potential refund while staying compliant with tax laws. This guide is designed to provide clarity and empower you with the knowledge necessary to manage your financial responsibilities effectively.

Read also:Leah Sava Jeffries A Rising Star In Hollywood

Table of Contents

Introduction to Colorado 1099-G Tax Refund

Colorado-Specific Information on 1099-G

The Filing Process for Colorado 1099-G

Common Questions About Colorado 1099-G

Understanding the Tax Refund Process

Read also:Office Siren Dti Revolutionizing Workplace Communication

Deductions and Credits to Optimize Your Refund

Avoiding Common Mistakes in Filing

Resources for Further Assistance

Introduction to Colorado 1099-G Tax Refund

The Colorado 1099-G tax refund process revolves around the information provided on the 1099-G form. This form is critical for taxpayers who have received payments from government agencies, as it helps determine the taxable income for the year. By understanding the nuances of this form, individuals can better prepare for their tax filings.

Colorado residents must be aware of the implications of the 1099-G form, as it directly affects their state and federal tax returns. Whether you've received unemployment benefits, state tax refunds, or other government payments, the 1099-G form ensures that these amounts are accurately reported and taxed accordingly.

This section will explore the foundational aspects of the 1099-G form, its relevance to Colorado taxpayers, and how it influences the overall tax refund process. By gaining a thorough understanding of this form, you'll be better equipped to manage your financial obligations and maximize your refund potential.

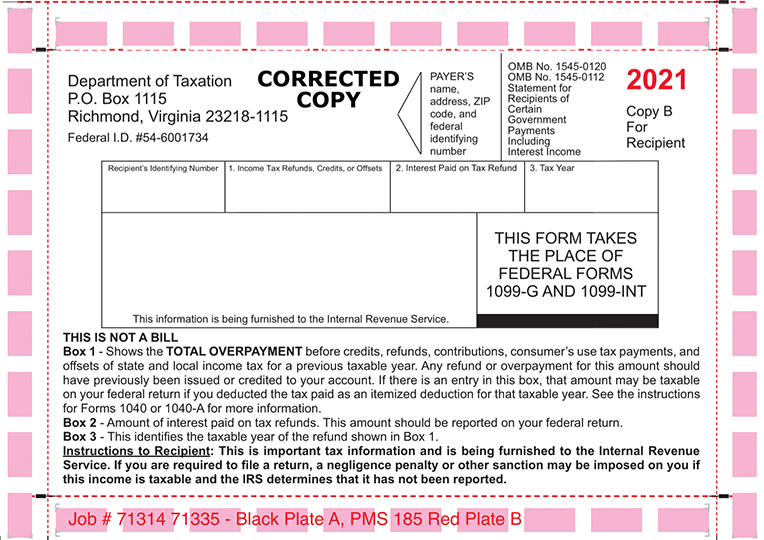

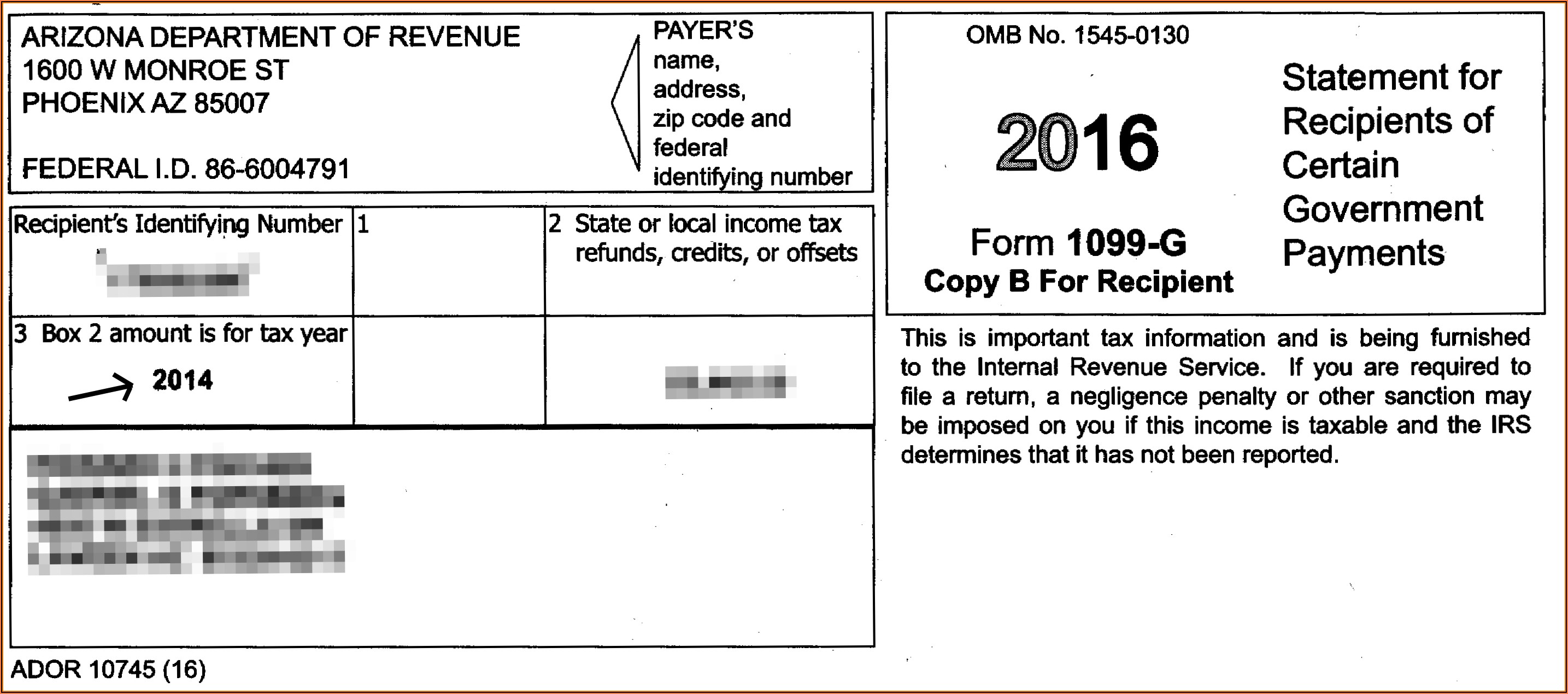

What is a 1099-G Form?

The 1099-G form is an IRS document used to report certain payments made by government agencies to individuals. These payments can include unemployment compensation, state or local income tax refunds, and other government-related disbursements. For taxpayers in Colorado, the 1099-G form plays a pivotal role in determining taxable income and eligible deductions.

Key Features of the 1099-G Form

Below are the essential components of the 1099-G form:

- Box 1: Total Payments – Indicates the total amount of payments made by the government.

- Box 3: Unemployment Compensation – Reports any unemployment benefits received during the tax year.

- Box 5: State Tax Refunds – Reflects any refunds received from state tax filings.

Understanding these sections is crucial for accurately reporting your income and ensuring compliance with tax regulations.

Colorado-Specific Information on 1099-G

Colorado has specific regulations and requirements regarding the 1099-G form. Residents must be aware of how the state treats various types of government payments and how they impact their tax returns. For instance, unemployment compensation received in Colorado is subject to federal and state taxation, and the 1099-G form ensures that these amounts are accurately reported.

Key Considerations for Colorado Taxpayers

Here are some important points for Colorado residents:

- State tax refunds reported on the 1099-G form may be taxable depending on the amount and circumstances.

- Unemployment benefits are fully taxable and must be included in your gross income.

- Government payments, such as grants or subsidies, may also require reporting on the 1099-G form.

By staying informed about these specifics, Colorado taxpayers can ensure they are meeting all necessary requirements and optimizing their refunds.

The Filing Process for Colorado 1099-G

Filing your Colorado 1099-G tax refund involves several steps, starting with gathering the necessary documents and ensuring all information is accurate. Below is a detailed breakdown of the filing process:

Step-by-Step Guide to Filing

- Collect all relevant documents, including your 1099-G form and W-2 statements.

- Review the information on your 1099-G form to ensure accuracy and completeness.

- Input the data from your 1099-G form into your tax return software or manually prepare your return.

- Submit your tax return by the deadline, either electronically or via mail.

By following these steps diligently, you can streamline the filing process and reduce the likelihood of errors or delays.

Common Questions About Colorado 1099-G

Many taxpayers have questions about the 1099-G form and its implications for their tax returns. Below are some frequently asked questions and their answers:

FAQs

- Q: Is the 1099-G form mandatory? A: Yes, if you have received government payments, you must report them using the 1099-G form.

- Q: How do I handle discrepancies on my 1099-G form? A: Contact the issuing agency to resolve any discrepancies before filing your tax return.

- Q: Can I amend my tax return if I receive a corrected 1099-G form? A: Yes, you can file an amended return using Form 1040-X to reflect the corrected information.

These FAQs aim to address common concerns and provide clarity on the 1099-G form's role in your tax filings.

Understanding the Tax Refund Process

The tax refund process involves several stages, from filing your return to receiving your refund. For Colorado residents, understanding how the 1099-G form impacts this process is essential for timely and accurate refunds.

Steps in the Refund Process

Here’s a breakdown of the refund process:

- Submit your tax return with all required forms, including the 1099-G.

- Wait for processing, which typically takes 21 days for electronic filings.

- Receive your refund via direct deposit or check, depending on your preference.

By staying informed about the refund timeline and requirements, you can ensure a smoother experience.

Deductions and Credits to Optimize Your Refund

To maximize your Colorado 1099-G tax refund, it's important to explore available deductions and credits. These can significantly reduce your taxable income and increase your refund amount.

Key Deductions and Credits

- Standard Deduction: Available to all taxpayers, this deduction reduces taxable income.

- Child Tax Credit: Provides a credit for qualifying dependents, lowering your tax liability.

- Education Credits: Such as the American Opportunity Credit or Lifetime Learning Credit, can offset education expenses.

By leveraging these deductions and credits, you can enhance your refund potential and better manage your finances.

Avoiding Common Mistakes in Filing

Mistakes in filing your Colorado 1099-G tax refund can lead to delays, penalties, or incorrect refunds. Below are some common errors to avoid:

Common Filing Mistakes

- Incorrectly reporting income or deductions.

- Missing deadlines for filing or amending returns.

- Not double-checking the accuracy of your 1099-G form data.

By being vigilant and thorough in your filings, you can minimize errors and ensure a successful refund process.

Resources for Further Assistance

For additional support and information on Colorado 1099-G tax refunds, consider the following resources:

- IRS Website: Offers detailed guidance on 1099-G forms and tax filing procedures.

- Colorado Department of Revenue: Provides state-specific information and resources for taxpayers.

- Tax Professionals: Consulting with a certified tax advisor can help ensure accuracy and compliance.

These resources can provide valuable insights and assistance throughout the tax filing process.

Conclusion and Next Steps

In conclusion, understanding the Colorado 1099-G tax refund process is essential for maximizing your refund and staying compliant with tax laws. By following the steps outlined in this guide, you can navigate the complexities of the 1099-G form and ensure a smooth filing experience.

We encourage you to take action by reviewing your 1099-G form, gathering necessary documents, and preparing your tax return. Don't hesitate to reach out for assistance if needed, and consider sharing this guide with others who may benefit from the information. Together, we can make the tax filing process more manageable and rewarding.