In today's financial landscape, subprime auto loans have become a crucial financing option for individuals with less-than-perfect credit scores. These loans provide a lifeline for people who may not qualify for traditional financing, enabling them to purchase vehicles they need for daily commuting or business purposes. However, navigating the world of subprime auto loans requires a solid understanding of how they work, their benefits, risks, and the factors influencing their terms.

Whether you're a first-time buyer or someone looking to upgrade your vehicle, subprime auto loans can open doors that might otherwise remain closed. This guide will walk you through everything you need to know about subprime auto loans, including eligibility criteria, interest rates, and strategies to improve your financial standing.

By the end of this article, you'll have a clear picture of whether a subprime auto loan is the right choice for your financial situation and how to make the most of it. Let's dive in and explore the ins and outs of subprime auto loans.

Read also:Lux Vip The Ultimate Guide To Elevating Your Lifestyle

Table of Contents

- What is a Subprime Auto Loan?

- Eligibility Criteria for Subprime Auto Loans

- Understanding Interest Rates for Subprime Loans

- Benefits of Subprime Auto Loans

- Risks Associated with Subprime Auto Loans

- Tips to Improve Your Credit Score

- The Subprime Auto Loan Application Process

- Alternatives to Subprime Auto Loans

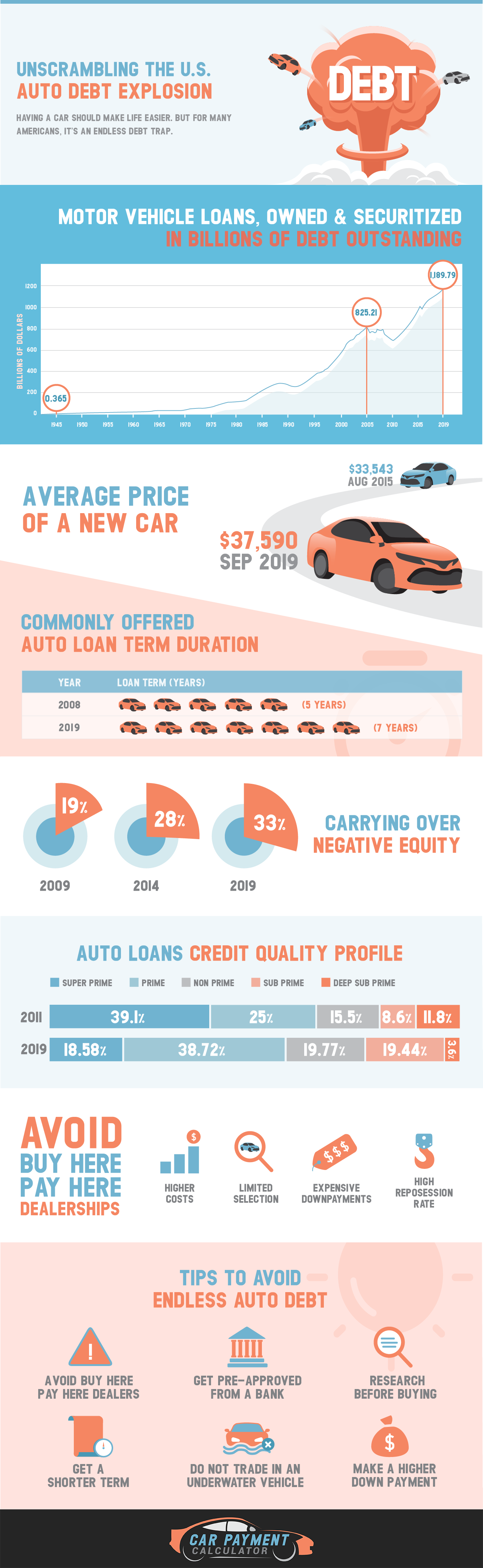

- Subprime Auto Loan Industry Statistics

- Frequently Asked Questions About Subprime Auto Loans

What is a Subprime Auto Loan?

A subprime auto loan is a type of financing designed for individuals with lower credit scores who may not qualify for traditional loans. These loans cater to borrowers with credit scores typically below 620, which is considered the threshold for prime lending.

Key Characteristics of Subprime Auto Loans

- Higher interest rates due to increased risk for lenders.

- Flexible loan terms, ranging from 24 to 72 months.

- May require a larger down payment compared to prime loans.

Despite the challenges, subprime auto loans can be a valuable tool for rebuilding credit and securing essential transportation. Understanding the nuances of these loans is essential for making informed financial decisions.

Eligibility Criteria for Subprime Auto Loans

While subprime auto loans are more accessible than traditional loans, lenders still have specific eligibility requirements. Below are some common factors lenders consider:

Factors Influencing Eligibility

- Credit Score: Lenders evaluate your credit history and score.

- Income Stability: Proof of steady income is often required.

- Debt-to-Income Ratio: A lower ratio increases your chances of approval.

Meeting these criteria can improve your likelihood of securing a subprime auto loan with favorable terms.

Understanding Interest Rates for Subprime Loans

Interest rates for subprime auto loans tend to be higher than those for prime loans. This is because lenders perceive borrowers with lower credit scores as higher risks. However, interest rates can vary significantly based on several factors:

Factors Affecting Interest Rates

- Credit Score: Higher scores generally lead to lower rates.

- Loan Term: Shorter terms often result in lower interest rates.

- Down Payment: A larger down payment can reduce interest rates.

It's important to shop around and compare offers from multiple lenders to secure the best possible rate.

Read also:Ashton Forbes Education Exploring The Academic Journey And Achievements

Benefits of Subprime Auto Loans

Subprime auto loans offer several advantages, especially for individuals with less-than-perfect credit:

Advantages of Subprime Loans

- Access to Financing: Enables borrowers to purchase vehicles despite credit challenges.

- Credit Improvement: Timely payments can help rebuild credit scores.

- Flexible Terms: Offers various repayment options to suit individual needs.

These benefits make subprime auto loans a viable option for many who need reliable transportation.

Risks Associated with Subprime Auto Loans

While subprime auto loans have their advantages, they also come with potential risks:

Potential Risks

- High Interest Rates: Can lead to significantly higher overall costs.

- Default Risk: Failure to repay may result in repossession and further credit damage.

- Prepayment Penalties: Some loans may charge fees for early repayment.

Being aware of these risks is crucial for managing expectations and avoiding financial pitfalls.

Tips to Improve Your Credit Score

Improving your credit score can enhance your chances of securing better loan terms. Here are some strategies to boost your credit:

Credit Improvement Strategies

- Pay Bills on Time: Consistent payments positively impact your score.

- Reduce Debt: Lowering your debt-to-income ratio can improve creditworthiness.

- Monitor Credit Reports: Regularly check for errors and address them promptly.

Implementing these strategies can lead to long-term financial benefits beyond just securing a subprime auto loan.

The Subprime Auto Loan Application Process

Applying for a subprime auto loan involves several steps:

Steps in the Application Process

- Research Lenders: Compare offers from multiple lenders to find the best terms.

- Prepare Documentation: Gather necessary documents, such as proof of income and identification.

- Submit Application: Complete the application process, either online or in person.

Thorough preparation and research can streamline the application process and increase your chances of approval.

Alternatives to Subprime Auto Loans

If subprime auto loans don't align with your financial goals, consider these alternatives:

Other Financing Options

- Co-Signer Loans: Adding a co-signer with good credit can improve loan terms.

- Leasing: Opting for a lease instead of a purchase can reduce upfront costs.

- Credit Union Loans: Often offer more favorable terms than traditional lenders.

Exploring these options can help you find the best solution for your financial situation.

Subprime Auto Loan Industry Statistics

The subprime auto loan industry has seen significant growth in recent years. According to data from the Federal Reserve, subprime auto loans accounted for approximately 25% of all auto loans in 2022. Additionally, the average interest rate for subprime loans ranges from 10% to 20%, depending on the borrower's credit profile.

These statistics highlight the importance of understanding the market and making informed decisions when pursuing subprime financing.

Frequently Asked Questions About Subprime Auto Loans

Here are some common questions about subprime auto loans:

Q: Can I get a subprime auto loan with bad credit?

A: Yes, subprime auto loans are specifically designed for borrowers with lower credit scores.

Q: How much down payment is required for a subprime auto loan?

A: Down payment requirements vary but typically range from 10% to 20% of the vehicle's price.

Q: Will a subprime auto loan help improve my credit score?

A: Yes, timely payments can positively impact your credit score over time.

Conclusion

Subprime auto loans provide a valuable financing option for individuals with lower credit scores. By understanding the eligibility criteria, interest rates, benefits, and risks, you can make informed decisions about whether a subprime loan is the right choice for your financial situation. Remember to explore alternatives, improve your credit score, and carefully evaluate loan terms before committing.

We invite you to share your thoughts and experiences in the comments below. Additionally, consider exploring other articles on our site for more insights into personal finance and lending options.